Health Insurance Made Easy

By: Erica Rodgers

Here at Seattle Sparkle, we are Professional Organizers and coaches who want to help our clients get organized the right way. We know without good health, it can be very hard to feel organized. When Jean started the organizing business in 2015, she chose to weave in Health Coaching, to highlight the integral role health has on organization. She has her Health Coaching Certifications through the Institute of Integrative Nutrition and The Health Coach Institute. Since we believe so strongly in good health, we wanted to take this time to talk about health insurance. Trying to shop for health insurance alone can be a real challenge, so we wanted to introduce you to expert Health Insurance agent, Frank Airey, with OneDigital. Enrollment is open from April 1st to April 8th as a response to the COVID pandemic. Frank can help you get coverage as low as $220 to $280, depending on where you live in Washington State. Be the adulting adult who not only has insurance but lets the experts help you in making thoughtful decisions about your potential future and the security of your health and financial status. You can contact Frank at 206-496-7387 or email frank.airey@onedigital.com.

What do the words “Health Insurance” do to you? Many people’s shoulders tighten at the sound of one of life’s safeguards. Health insurance is often the same stubborn confusion that is also a Rubik’s cube. Health insurance and the cube are both puzzles that seem fairly easy to work with and solve: twist the cube to get the same colors on one side and you are sick so you go to the doctor with your health insurance card in hand. Unfortunately, we have a complicated system, even at the best of times…Insert a very knowledgeable insurance agent who has let me ask some of the same questions he gets asked every day, Frank Airey.

Many want to feel more confident when working with their health care plan. Whether it is choosing a plan for your employees, reviewing insurance options for yourself and your family, enrolling, or deciding on a doctor, the knowledge of needing to come to a decision is often more than what we have within ourselves and our time. With COVID-19 uncertainties, insurance, as well as financial security, has been a cause for concern. Even if the testing for COVID and the services related to a COVID diagnosis are covered, the following months and years will have people more interested in insurance and how to maintain a plan that will suit them, no matter what the circumstance.

Frank and I had quite the frank discussion (sorry, Frank, I had to do it). We did start off light, though. He told me he randomly landed in health insurance, because “not too many people grow up saying they want to work in insurance”. The Health and Benefits Agent position was provoked by a friend who thought Frank would be a good fit. It ended up to be a fantastic fit. He remarked that he was once the young man who knew very little about insurance and learning this role could help a lot of people as he noticed there were quite a few people who were confused by the current health system and how their plan or potential plan fits in their life.

One Digital is the company Frank is an agent with. Although the company works with all 50 states, they focus on the Pacific Northwest. Specifically, Frank and the Seattle office are geared towards small and medium-sized businesses as well as families and individuals. This includes helping individuals enroll and choose Medicare and supplement plans as well.

All this sounds fantastic to me, a layman of the health insurance world, even though I have worked with insurances throughout my time, I can tell Frank is way ahead of my game. Insurance Agents are experts and as Frank mentions, “as long as you have an honest and attentive agent you will be getting the health care plan that is suitable for your needs”.

Frank’s “services don’t cost a dime”. I wanted to make sure I heard that right, specifically in the consultation arena or the questions from someone who is already enrolled and just needing guidance or information to make an educated decision. Yes, in fact, all services are free. No matter what your health insurance situation is, consults, education, enrollment, resources, one employee or 20 employees, all services are free. Which is good news for every single person.

Now we know how Frank, an honest and attentive Health Insurance Agent, can help you. I asked about some memorable moments in his career that stand out. How these stories are recounted means a lot.

Small Employer: “I got a referral from a past client, a small business owner, down in the SODO area. I was able to negotiate lower rates enough to hire another employee, a marketing person. That was their goal for the year, made that happen in a month.”

Side note: It is a big win to help a business, individual or a family like this. During this time of economic uncertainty, lowering rates to free up money for, well, anything, makes a lot of sense.

Medicare: “Many people stay with us as they transition from the work-force to retirement. Anyone who is 64+ knows that the spam mail gets a little much with ads for different Medicare supplemental plans. Most of the plans that are spam offer poor coverage. One option for Medicare recipients for a supplemental plan is a $200 deductible. I switched one of my clients over to this plan. She called me months later, crying, thanking me for switching her over because she was recently diagnosed with cancer. She was so thankful that she wouldn’t have to pay anything over $200.00. She is now healthy and not only saved money but also peace of mind throughout the cancer treatment process. I don’t get paid a lot per client, but it feels really good to make a bold recommendation and it work for a client.”

Let’s not forget to lay out the dreaded words that confuse so many. Frank says “it doesn’t matter how brilliant a person may be, everyone gets confused by these terms”.

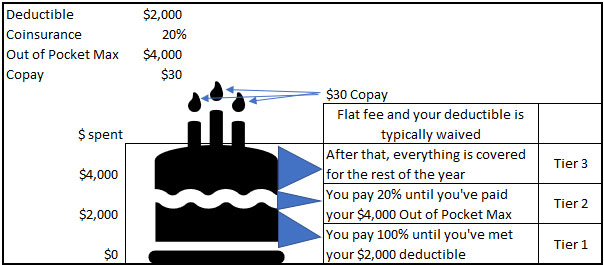

Copay – This is a flat fee you pay for a specific service (such as an office visit) at the time you receive the service

Deductible – The amount you pay in medical costs before your health plan begins to pay

Coinsurance – Your percentage of the cost for a service. You pay 100% until your deductible is paid, then you pay your coinsurance (usually 20%-30%)

Out of Pocket Max – the maximum amount of money you will pay for covered services in a calendar year

Frank gave a good visual example:

A few tips that Frank shared that people should be aware of but often are not:

- You get what you pay for. Cheapest plan, cheapest results, for example.

- You don’t have to do it on your own. A Health Insurance Agent can help you in about 30 minutes or so.

- Don’t listen to your friends, their plan is different.

- Our services don’t cost a dime. ALL consultations are at no cost and after a thorough chat, the agent will ask to be officially signed as your Insurance Agent, sometimes all you have to do is say yes, others you have to sign a document. When a new client is established we get paid a commission from the insurance companies, which all pay about the same. You don’t pay any extra in premiums and in fact, the service that the Insurance Agent is providing you could save you.

This blog was specifically made to help others feel supported through this 2020 health juncture. Please reach out to the experts to get your specific questions answered. All communications can be done over the phone. To note- Frank usually likes to do consultations or meetings in person, but times are different at the moment so phone or video chat is accessible. In short, with health on the mind lately, check your health insurance. Or if you don’t have any, please enroll. Contact Frank at 206-496-7387 or email frank.airey@onedigital.com.

What are you doing to boost your immunity?? Let us know in our Facebook group, Declutter and Organize with Seattle Sparkle.

By Erica Rodgers

Digital Organizer, Virtual Assistant, Motivational Coach

Seattle Sparkle